With summer right around the corner, you want to make sure that your oil level is good in your vehicle before you head out on the road with your family. Our very own Nate from the Chevrolet Service Department shows you how to check your oil level. Be sure to check yours often to ensure you get where you need to go without and setbacks this summer.

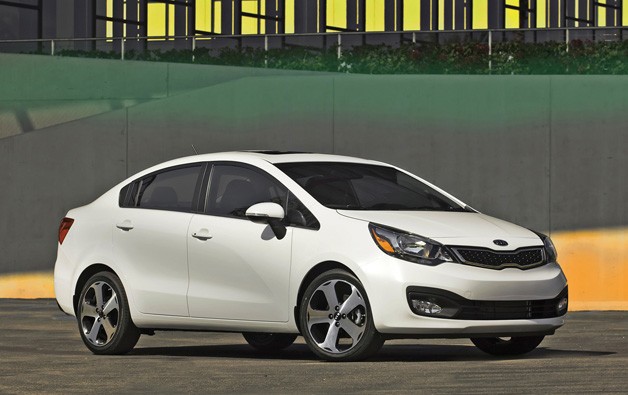

Kia Rio takes top spot in Consumer Reports subcompact sedan evaluation.

By Zach Bowman

http://www.autoblog.com/2012/03/23/kia-rio-hyundai-accent-and-chevy-sonic-top-consumer-reports/

Consumer Reports has just wrapped up an evaluation of subcompact sedans, and the Kia Rio EX has rolled out ahead of the class. The four-door beat out its corporate clone, the Hyundai Accent and the Chevrolet Sonic to take the top spot. Evaluators pointed to the sharp handling and well-optioned interior in the Rio as reasons for the vehicle’s win. The newly redesigned Nissan Versa and unloved Toyota Yaris filled out the top five sedans. And what of the baby hatchbacks? CR once again credited the Honda Fit as leader of the pack, followed closely by the Versa Hatchback and Rio Hatchback.

The organization found fault with the base Chevrolet Sonic’s fuel economy, and found the turbocharged LTZ model to be too expensive. Evaluators also felt the Sonic Turbo “didn’t live up to its sporty aspirations.”

We’ll politely agree to disagree on that one.

All of the vehicles in the evaluation are either too new or scored too low in CR evaluations to earn a coveted Recommended rating. Hit the jump for a look at the full press release and debate amongst yourselves in Comments.

Read more: http://www.autoblog.com/2012/03/23/kia-rio-hyundai-accent-and-chevy-sonic-top-consumer-reports/

Expect new Chevrolet Colorado to the US in 2015

March 21st, 2012

March 21st, 2012

www.gminsidenews.com

by: Alex Villani

After it’s reveal at the Bangkok Motor Show last year, the new global Chevrolet Colorado quickly gained traction as General Motors announced that it would be coming to the North American market as well. Unfortunately, much misinformation came with it; with publications assuming the truck would arrive immediately following the death of the current Colorado truck, but that is not the case. The new Colorado is still two years away for North America.

The general consensus has been that the new Colorado would arrive in 2013 model year. On the surface, that seems like a plausible timeline considering the truck is going on sale in certain global markets this year and the current Colorado is slated to end production this year. Unfortunately GM has a reputation for waiting extended periods of time before bringing global products to North America and the new Colorado is no exception.

Instead of 2013, expect the new Colorado to launch as a 2015 model year vehicle in North America. There are several, logical reasons for the wait.

For starters, the Colorado that just launched on the global scene is not specifically designed for North America. GMI has been told that GM is holding off and giving North America an updated version of the truck in 2015; one that will meet all U.S. standards and be an overall better truck. This updated version will proliferate the global markets as well.

This launch strategy is not new at GM. The same strategy took place with the Chevrolet Spark mini car. It has been on sale in most global markets for nearly two years, but North America has waited until 2013 model year to get an updated version of the car.

The second issue with the new Colorado is North American production. GM has already announced that the Colorado will be built at their Wentzville, Mo. assembly plant. However anyone with any knowledge on automotive manufacturing knows that it isn’t feasible to retool a plant for a completely new vehicle line and chassis in the matter of a few months (the investment was just announced in November).

Factoring in those two, very large issues and a start of production date in 2014 becomes far more realistic. In fact, when GM announced the new Colorado would make it to the North American market they hinted that it would be awhile until it hits the streets.

Just like the Cruze, Spark and Sonic/Aveo, it sounds like the Colorado will have its own development process for the North American market.

While Chevrolet has not announced engines for the North American Colorado, GMI has been told to expect GM’s new 2.5-liter four-cylinder and 3.6-liter V-6. Both engines have a wide range of outputs, so specific outputs for the Colorado are entirely unknown at this time.

In most global markets the Colorado is powered by a 2.8-liter diesel engine. It is unclear if the diesel engine will make its way to North America as well.

Expect the new, updated Colorado to launch in North America in mid-2014 as a 2015 model.

Read more at: http://www.gminsidenews.com/forums/f70/new-chevy-colorado-two-years-out-u-s-buyers-109542/